This is the first of what will probably be a series of pretty technical posts dealing with some of the nuts and bolts of infrastructure finance and economics. I don't want to do too many of these, but there are a few things that I figured out that took me a lot of blood, sweat and tears that I'd like to save some others if I can. If you're not in the business of making or using financial models on a regular basis, please feel free to skip this one!

When you build a financial model, there are two ways you can manage your numbers: real, and nominal. In real models, you pick a base year, and do all your calculations using constant real dollars, rupiah or whatever currency you’re working in. In nominal models, you need to adjust all of your numbers by the relevant inflation figure.

Whether you use real or nominal is largely a matter of personal taste. They are (or, at least, should be) mathematically equivalent. It’s more a matter of presentation. I have always been a bit of a nominal model man. The first professional model I ever took over from someone was a nominal model, and I guess that shaped how I think about these things, but, at least theoretically, I don’t mind much which flavour you want to use.

I said “at least theoretically”, because in practice, I have had lots of problems with real models. In fact, a significant number of the real models I have come across in my professional career have had the same glaring mistake. Take a look at the simple models below and see if you can see what it was.

Let’s imagine you work for the government and your boss wants you to analyse an infrastructure project to find out how much a private party will charge users to provide the service.

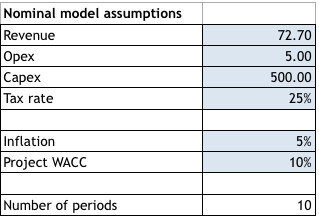

The project will operate at full capacity for a 10-year period providing a service for which it charges a tariff and incurs operating expenses that both increase with inflation. The business is pretty capex heavy and the capex is all incurred in the first year of operations, then depreciated on a straight-line basis over the 10 year operating period. You’ve got some cost estimates, and a pretty good idea of what the weighted-average cost of capital is for businesses in this industry, so you put all the costs in and run a goalseek to get your full-cost-recovery tariff.

First you make a real model (but unknowingly, make a mistake in its design). See below:

Then you make a nominal model to check your work (which doesn’t have the equivalent mistake). All you need to do is adjust the WACC, your revenues and your opex by inflation; everything else flows on from those.

You are alarmed to see that your full-cost recovery tariff is different between the two models that should be mathematically equivalent. What have you done wrong?

Have you found the mistake? Last chance…

….

….

….

The mistake is in the depreciation. In the real model (and in a significant proportion of real models I have seen in the real world) depreciation has been assumed to be constant. In fact, straight-line depreciation is constant in nominal terms, and decreases in real terms. The 50 units of your year 1 capex that you depreciate in year 10 is worth a lot less in real terms than the 50 units of the capex that you depreciate in year 10. This doesn’t affect your pre-tax cashflows, but, if you keep the depreciation constant, the tax shield impact of your depreciation is overstated.

Here’s the real model with deflated depreciation that results in the correct full-cost-recovery tariff.

This effect of this mistake is not always very large, it’s only so large here because I used an example that was particularly capex heavy, but it can have a significant impact on decision-making in businesses like infrastructure where profit margins are very slim.

People think that in a real model, they don’t need to assume inflation. This is true if it’s a pre-tax model, but in a post-tax, or vanilla model, you still need to assume an inflation rate to calculate your depreciation correctly (and amortisation, etc.). So, I said earlier that it was largely a matter of taste what sort of model you make. That’s true, but if you’re building a real model, which is anything other than pre-tax, I might question your taste… Having to assume an inflation rate for a real model, to me, should make you question why you are using a real model in the first place.

So, now you know. Next time you see a real model, have a look at the depreciation, and let me know if you find the same mistake. The ones I have found have been made by very successful, multi-billion dollar companies, so the people making these mistakes aren’t in bad company, at least…