About three weeks ago, the Minister of Public Works and People’s Housing Basuki Hadimuljono reported that his ministry was looking into extending the concessions of toll roads in an effort to reduce toll road tariffs. Katadata reports that this was in response to an order from President Joko Widodo to reduce toll road tariffs this year, as he had received many complaints from the public that they were too expensive.

This obviously begs the question: how much does extending a toll road concession period lower tariffs? (Spoiler for those who want to skip ahead: comfortably less than 2%).

OK, so we need to build a financial model and collect a bunch of data?

Actually, we don’t need to build a financial model, and don’t need to collect much data at all.

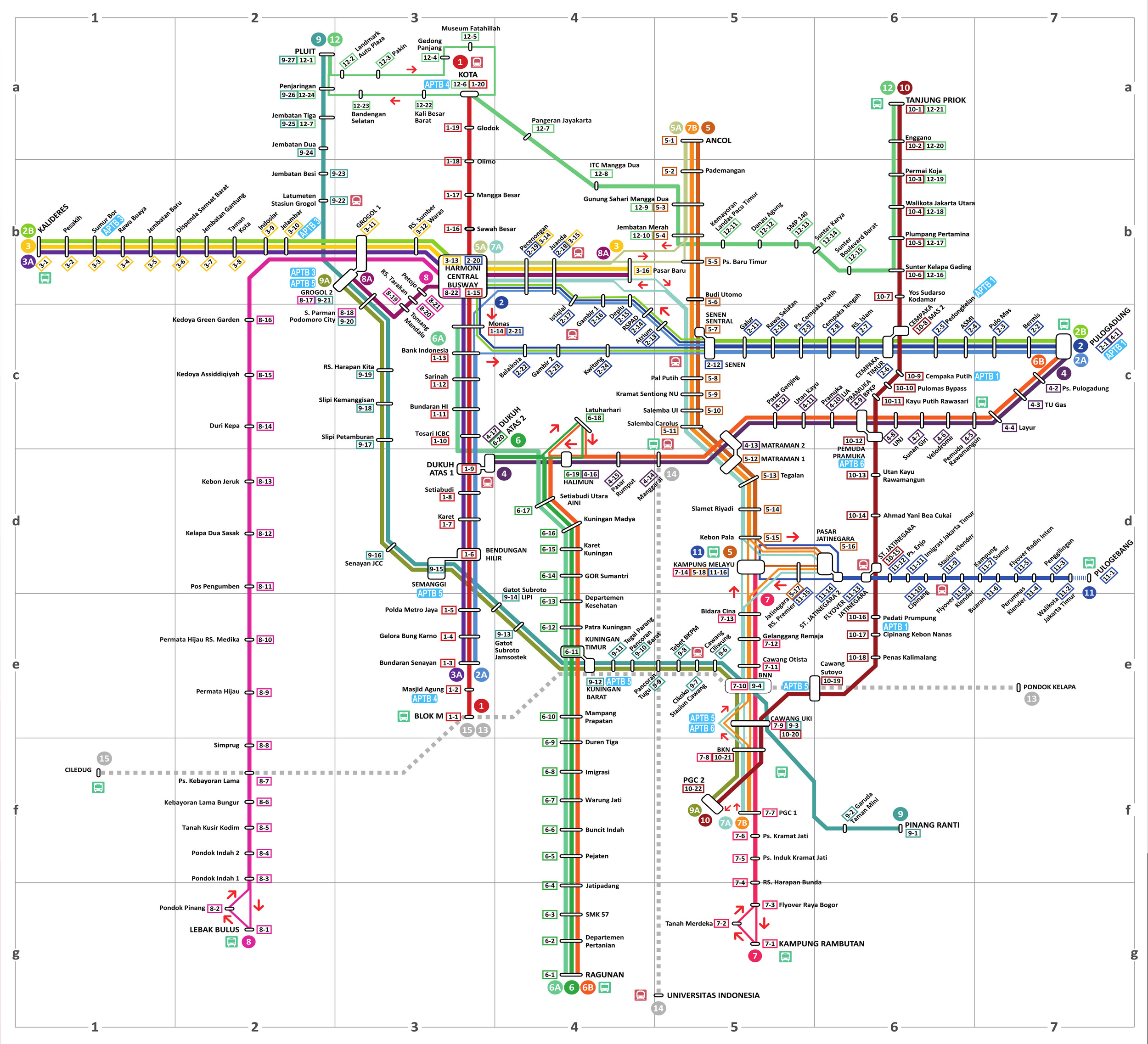

If all we need to know is the percentage change in tariff, we can get in the right ballpark with just the following data:

- The current length of the toll road concession in question

- Concession lengths that range from 31 to 50 years with an average all toll roads of 39.3 years (BPJT), so let’s say 40 years.

- The desired length of the concession

- Minister Basuki is quoted as saying that they’re considering extensions to various lengths from to 45-60 years

- The weighted average cost of capital (“WACC”) for Indonesian toll roads

- Over the past few years it has been on the order of 12-16%, but it’s probably higher at the moment due to recent erratic regulation in toll roads, and other infrastructure sectors.

- The share of capital expenditure in total project cash outflows

- Capex usually accounts for about two-thirds of cash outflows over the life of a toll road project, in present value terms

We can do this by using the PMT() function in Excel, and just modelling all of the cashflows as an amortising loan payment using the tenor of the loan as the number of periods, and the WACC as the interest rate.

So as you can see in the table above, even if we set the WACC at an unrealistically low figure of 9%, and extend the concessions all the way out to 60 years, on average, the impact on the tariff is going to be less than 2%. More than likely, it’s going to be less than 0.5%.

(Nerd note: in fact, it’s going to be even smaller than that, because amortising loan payments are constant in nominal terms, while toll road tariffs in Indonesia grow roughly at inflation, so will be backloaded; hence, further discounted. And it’s not like you can get debt on a 60 year tenor either, so you’re still going to be front-loading debt payments, and back-loading dividends, whether it’s a 20 year or a 60 year concession. In any case, the impact is comfortably less than 2%)

Why is the impact so small?

It can be counterintuitive that adding 20 years to a 40-year concession has such a small impact on the tariff; after all, there’s another 20 years’ worth of traffic to spread the capital costs over. The problem is that, 40 years in the future, those cashflows aren’t worth that much in today’s money.

Even at a 9% discount rate, one dollar in 40 years is only worth 3 cents in today’s money, so the many millions of dollars of revenue that a toll road might earn in years 41 to 60 really don’t do a lot to lower the tariff required to cover the project costs projected in today’s money.

Is lowering toll road tariffs even desirable?

The purported aim of this policy is to reduce logistics costs incurred by Indonesia’s businesses while transporting goods on roads. This is a laudable aim, after all, Indonesia’s logistics costs are among the highest in the world as a share of GDP; accounting for 26% of GDP in 2016, compared to 14% in Malaysia, and 8% in Singapore.

However, the main drivers of roads logistics costs are not toll road tariffs, but rather congestion, and wear and tear on cars due to poor quality roads. If you did lower toll roads tariffs a significant amount, you could conceivably increase traffic on the roads, making traffic worse, and increasing the logistics costs overall.

Floating policies like this drives investor perception of risk

Any infrastructure developer knows that an extra 20 years on their concession will have a negligible amount on tariffs, so the government looks unprofessional when they go public with policies like this. In a developer’s eyes, it looks like the government is politicising toll road tariffs, increasing regulatory uncertainty; the impacts of which they are very familiar with.

As I said in my article in the Lowy Institute’s Interpreter blog in August last year “The government’s propensity to undertake post-bid renegotiations is part of the reason that cost of capital for utilities developers in Indonesia is closer to the neighbourhood of its lower-income ASEAN neighbours Vietnam, and Cambodia, rather than its lower-middle-income peers of the Philippines and Thailand.” (Check out that post for the accompanying graph).

Summing up

Extending toll road concessions is not an idea that is worth the attention that has been paid to it over the past few weeks. It won’t lower tariffs by a significant amount, and it’s not clear that lowering tariffs is a sensible policy aim anyway. By promoting this policy, the government stoking investors’ perceptions of regulatory uncertainty, keeping the cost of capital high.

Looking back at the table above, it strikes me that the tariff is dramatically more sensitive to changes in WACC than it is to changes in the length of the concession period. It could be that announcing this policy has already had an impact on future toll road tariffs, but not in the direction that the government was hoping.